The proposed extension of the Home Guarantee Scheme to regional areas could worsen housing affordability and fuel higher construction costs as the additional demand squeezes supply, experts say.

At the same time, the amount of new housing that could be generated by the scheme is too small to make a dent on the existing housing shortfall, which has resulted from regional migration.

Said Domenic Nesci, director of buyers’ agency Wealthi: ‘‘It’s going to make it even harder to buy into regional markets because of renewed competition, but it will also mean the market will be tighter as demand increases.

‘‘The scheme will [increase prices] in the regional markets as the grant incentivises people to stretch for homeownership, and will bring forward many homeowners that would have needed to wait the additional two to three years to save the remaining 5 per cent to 15 per cent deposit.’’

The scheme, which aims to help first home buyers make a purchase with just a 5 per cent deposit and without having to paying lenders mortgage insurance, will now be offered to regional buyers with slight variations.

People in country areas who have bought their first home and permanent residence will also have access to the scheme, which guarantees up to 10,000 homes each year from October this year to July 2025.

Home buyers can build or buy a new home in the regional areas within the price cap to be finalised before the release date in October.

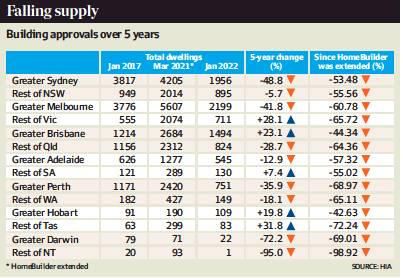

However, the pipeline of new homes in the regions had already fallen sharply since the HomeBuilder grant, which offered a $25,000 subsidy for first home buyers to build their home, was extended in March last year.

Housing Industry Australia data found that total dwelling approvals fell by 55.6 per cent in regional NSW; fell 65.7 per cent in regional Victoria and dropped 64.4 per cent in regional Queensland.

HIA executive director for industry policy Geordan Murray said: ‘‘What we saw throughout COVID was a very sharp change in housing preferences during the pandemic and a surge in demand for housing in regional areas.

‘‘The supply of housing takes a long time to respond to variations in demand.

‘‘While the regional housing markets are responding, they’ve never been in a position where they have had to respond to such a dramatic change in demand.’’

Kent Lardner, director of data analytics and consultancy company Suburbtrends, said the exodus from the city had placed immense pressure on the regions.

‘‘When you count total building approvals in the last 15 months for houses, this represents less than 1.5 per cent of total housing stock in most of these eligible markets,’’ Mr Lardner said.

‘‘Demand already exceeds supply here, which is keeping strong upwards pressure on prices. Any policy that amplifies demand will only push prices up further, given the current market conditions. I can’t see how this policy helps affordability.’’

Henderson Advocacy buyer’s agent Jack Henderson said the small number of available grants would have little impact in boosting supply in the regions.

‘‘There’s only 10,000 new housing expected to be built each year across the regions, that amount of supply will not be enough to satisfy the existing demand,’’ he said.

‘‘We have a huge deficit of regional housing, so I don’t think it will put a huge dent in the overall supply shortfall that we’re in right now.’’

The extra demand for new construction would also fuel further increases in building costs, said Marty Sadlier, director of MCG Quantity Surveyors.

‘‘It will drive higher building costs because of the current tight labour market and material shortage,’’ he said.

‘‘It’s very difficult to build in the regions at the moment, with many tradies having supply issues and heightened demand due to the floods in the east coast.

‘‘Materials will be funnelled to the most impacted areas; therefore the regions will see extended material lead times and severely increased material costs.’’